ADVENT VAT Compliance Check

Post-implementation Compliance review

Are you happy with your VAT Implementation?

VAT has been live in UAE for over 8 months and hopefully, your systems and processes have been able to bed-in during this time.

Recent market research indicates that FTA started to take an increasing level of interest in carrying out audits and visits to companies. Many businesses have simple systems or processing errors which led to penalties being applied and assessments being raised for such mistakes that could easily have been avoided.

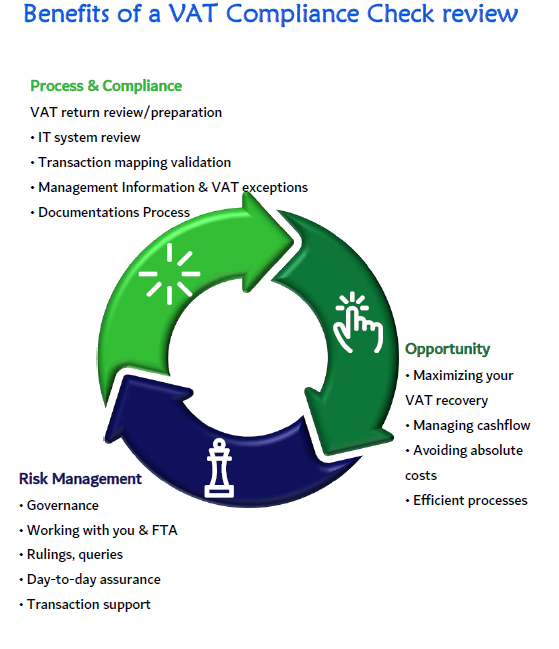

Advent Management & Tax consultancies have designed unique methodology to review for post-implementation compliance so that these errors and issues can be identified and fixed. If your business has not considered a review so far following the implementation of VAT, we strongly advise carrying out a post-implementation review to check and validate your compliance.

You might have already worked with an adviser to implement VAT, in which case we will work with you to test and validate findings, assumptions and processes to verify that these are working correctly in practice and to help minimize any future risks.

Advent VAT Compliance Check process and report is thorough, comprehensive and will give you the assurance that you are doing things right. And if you’re not, don’t worry as we will be on hand to help you fix things by communicating with FTA, refining your ERP, or by providing training to your staff.

For more information and consultation about the VAT compliance check services, please contact

Zahid Farooq

GCC Indirect Tax Expert